Millennials are 25 percent more likely to report that they have lost money to fraud than consumers aged 40 and over, according to a new Federal Trade Commission analysis of consumer complaint data.

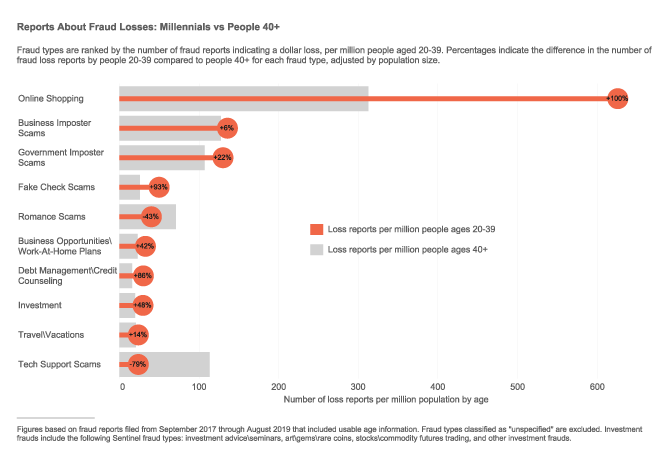

The FTC’s latest Consumer Protection Data Spotlight shows that millennials—those ages 20-39—are twice as likely to report losing money to online shopping fraud than those 40 and over. Online shopping fraud reports include complaints about items that are never delivered or are not as they were advertised. Millennials reported losing $71 million to online shopping fraud—out of the nearly $450 million they reported losing to all types of fraud—in the last two years.

Other categories where millennials are much more likely to report losing money to fraud than consumers 40 and over include fake check scams, offers that promise to help fix debt-related problems, or offers promising income through jobs, investments, or business opportunities.

People 40+ report those same scams, too, but the data suggest that, with the exception of romance scams, Millennials may be less likely to avoid them or may encounter them more often. For example, Millennials are twice as likely as people 40+ to report losing money while shopping online. Frequently, shopping-related reports to the FTC are about items that are never delivered or aren’t as advertised.

Millennials are also more likely than their older counterparts to report fraud losses on scams that promise to fix debt-related problems or that promise money through jobs, investments, or business opportunities. Millennials are 93% more likely than people 40+ to report losing money to fake check scams, which also often look like a way to earn money.

Millennials are 77% more likely than their older counterparts to say they lost money to a scam that started with an email.

The Federal Trade Commission works to promote competition, and protect and educate consumers.

Chattooga Local News

Georgia DOT Seeks Public Input on Proposed Summerville Bypass

Bulloch Public Safety

7/11/2025 Booking Report for Bulloch County

Chattooga Sports

Indians Compete at Cedartown 7-on-7, Gear Up for Final Summer Camp

Bulloch Public Safety

7/10/2025 Booking Report for Bulloch County

Bulloch Public Safety

06/23/2025 Booking Report for Bulloch County

Bulloch Public Safety

06/30/2025 Booking Report for Bulloch County

Bulloch Public Safety

06/16/2025 Booking Report for Bulloch County

Bulloch Public Safety

06/19/2025 Booking Report for Bulloch County

Bulloch Public Safety

7/09/2025 Booking Report for Bulloch County