Being a homeowner is expensive and the rising costs of insurance never help. Recent studies show that average home insurance rates have risen in every state in the last decade, according to Quote Wizard.

But which ones were the worst?

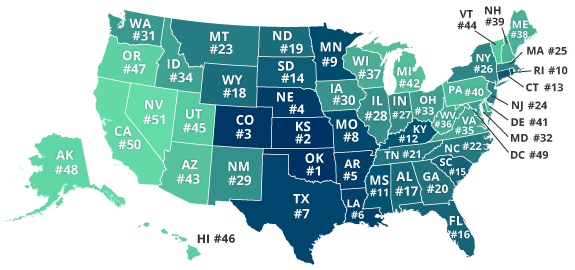

In this week’s Map Monday, we examine which states saw the biggest increases on their insurance rates in the most recent year with data available – 2015.

From QuoteWizard:

The National Association of Insurance Commissioners releases annual reports on insurance trends and stats. These reports include average home insurance rates for every state. Rate data is based on HO-3 policies, the most common home insurance policy.

The NAIC recently released their 2015 report, the latest full-year data available. In the table below, we compare home insurance rate data from the NAIC’s 2007 report with its recent 2015 report. By doing so, we can assess which states saw the biggest increases in homeowners insurance rates.

| Ranking (Worst) | State | Rate Difference |

| 1 | Oklahoma | $825 |

| 2 | Kansas | $627 |

| 3 | Colorado | $557 |

| 4 | Nebraska | $553 |

| 5 | Arkansas | $550 |

| 6 | Louisiana | $545 |

| 7 | Texas | $543 |

| 8 | Missouri | $527 |

| 9 | Minnesota | $523 |

| 10 | Rhode Island | $496 |

| 11 | Mississippi | $489 |

| 12 | Kentucky | $484 |

| 13 | Connecticut | $482 |

| 14 | South Dakota | $478 |

| 15 | South Carolina | $476 |

| 16 | Florida | $459 |

| 17 | Alabama | $453 |

| 18 | Wyoming | $432 |

| 19 | North Dakota | $429 |

| 20 | Georgia | $428 |

| 21 | Tennessee | $426 |

| 22 | North Carolina | $401 |

| 23 | Montana | $381 |

| 24 | New Jersey | $373 |

| 25 | Massachusetts | $356 |

| 26 | New York | $351 |

| 27 | Indiana | $336 |

| 28 | Illinois | $333 |

| 29 | New Mexico | $315 |

| 30 | Iowa | $309 |

| 31 | Washington | $305 |

| 32 | Maryland | $982 |

| 33 | Ohio | $279 |

| 34 | Idaho | $270 |

| 35 | Virginia | $263 |

| 36 | West Virginia | $261 |

| 37 | Wisconsin | $259 |

| 38 | Maine | $247 |

| 39 | New Hampshire | $242 |

| 40 | Pennsylvania | $224 |

| 41 | Delaware | $221 |

| 42 | Michigan | $187 |

| 43 | Arizona | $176 |

| 44 | Vermont | $169 |

| 45 | Utah | $168 |

| 46 | Hawaii | $164 |

| 47 | Oregon | $147 |

| 48 | Alaska | $121 |

| 49 | Washington D.C. | $107 |

| 50 | California | $61 |

| 51 | Nevada | $42 |

Note: This data is used with permission of the NAIC.

Jessica Szilagyi is a former Statewide Contributor for AllOnGeorgia.com.

Bulloch Public Safety

12/23/2024 Booking Report for Bulloch County

Bulloch Public Safety

GDOT: Traffic Impacts for the I-16 at I-95 Improvement Projects Through December 28

Bulloch Public Safety

11/25/2024 Booking Report for Bulloch County

Bulloch Public Safety

12/09/2024 Booking Report for Bulloch County

Bulloch Public Safety

12/02/2024 Booking Report for Bulloch County

Bulloch Public Safety

12/16/2024 Booking Report for Bulloch County

Bulloch Public Safety

12/12/2024 Booking Report for Bulloch County